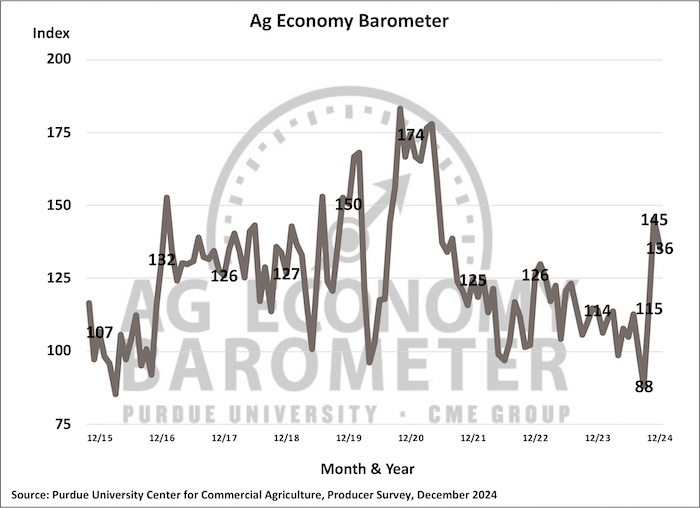

Farmer sentiment drifted lower in December as a result of the Purdue Faculty/CME Group Ag Monetary system Barometer dropped 9 components to a learning of 136. The decline was pushed by producers’ weaker perspective on current circumstances in U.S. agriculture and their farms, with the Index of Current Conditions falling 13 components to 100. Although the Current Conditions Index declined this month, it stays 24 components above its low in September and 5 components elevated than in October. The Index of Future Expectations moreover fell 8 components to 153, remaining 59 components above its September low and 29 components elevated than the October learning. This month’s survey was carried out from Dec. 2-6, 2024.

Whereas sentiment dipped this month, it’s clear that plenty of the post-election optimism about future circumstances continues to be holding sturdy. Producers’ optimism regarding the future seems to stem largely from their expectations for a additional favorable protection setting over the following 5 years. Farmers’ views on the current and long-term outlooks for agriculture confirmed some noticeable variations in December. Whereas sentiment regarding the current state of affairs and the one-year outlook was additional cautious than in November, expectations for the agricultural sector over the following 5 years have been notably additional constructive. The share of producers anticipating widespread good events in U.S. agriculture over the following 5 years elevated to 57%, from 52% in November and 34% in October. This optimism extended all through every the crop and livestock sectors, with 4-point and 5-point will improve, respectively, inside the proportion of respondents anticipating good events. In distinction, views on the near-term outlook have been a lot much less favorable. When requested about financial circumstances on their farms as compared with a 12 months prior to now, 57% of producers reported worse circumstances in December, up from 51% in November. Equally, 51% of farmers expressed concern regarding the U.S. agricultural financial system over the following 12 months, an increase from 40% in November.

Following a 13-point improve in November’s survey, the Farm Capital Funding Index fell 7 components to a learning of 48. The weakening in funding sentiment was mirrored in a lower proportion of farmers who take into account it is a good time to take a position, dropping to 17% from 22% in November. On the equivalent time, the proportion of producers who thought of it as a nasty time to take a position elevated barely to 69%, up from 67%. This dip in funding sentiment mirrored the decline inside the Farm Financial Effectivity Index, which fell 8 components in December to 98.

Persevering with the sample from November, the Fast-Time interval Farmland Price Expectations Index dropped 5 components to a learning of 110, following the identical 5-point decrease the sooner month. No matter these two consecutive decreases, the short-term index stays properly above its low of 95 in September. The Prolonged-Time interval Farmland Price Expectations Index, which shows producers’ outlooks for farmland values over the following 5 years, decreased by merely 1 stage to 155.

Farmers’ outlook for the way in which ahead for his or her farms and the agricultural sector stays noticeably additional constructive than on the end of summer time season. This shift appears to be pushed by expectations of protection modifications following the 2024 election, considerably in areas resembling environmental, property and earnings tax insurance coverage insurance policies. Foremost as a lot because the election, over 40% of producers anticipated additional restrictive environmental legal guidelines over the following 5 years. Nonetheless, following the election, fewer than 10% expressed concerns about tighter legal guidelines. Equally, 40% of farmers anticipated property taxes to rise sooner than the election, nevertheless decrease than 10% foresee an increase in property taxes inside the following 5 years. Regarding earnings taxes, virtually 38% of producers anticipated rises sooner than the election, with that proportion moreover dropping beneath 10% postelection. Lastly, higher than half (55%) of survey respondents depend on the election consequence to lead to a stronger farm earnings safety net than was in place earlier to the election.

One ongoing concern for U.S. farmers is the way in which ahead for worldwide commerce in agricultural merchandise. In December, 4 out of 10 (43%) farmers chosen “commerce protection” as essential protection for his or her farm inside the upcoming 5 years. Every the November and December barometer surveys requested producers regarding the likelihood of a “commerce battle” which may negatively impact U.S. agricultural exports. The outcomes level out that many producers keep apprehensive about this case. In December, 48% of farmers acknowledged they take into account a commerce battle that harms agricultural exports is each potential (32%) or very potential (16%), an increase from 42% in November. Conversely, solely 21% of respondents in December thought of a commerce battle as each unlikely (17%) or impossible (4%), down from 26% in November.