The lenders that supported Spice Creek Farm are two of numerous completely different farm finance organizations which have sprung up over the previous couple of a very long time to help the long-term success of small, regenerative farms.

“I’d take into consideration plenty of farmland merchants have to see numbers on a spreadsheet about how one can maximize yield from acreage,” he says. Instead, Israelow and his crew are collaborating within the prolonged recreation. “Gail is clearly envisioning her future on that property for the rest of her life. She’s not like, ‘What can I do subsequent 12 months to maximise my revenue from it? She’s like, ‘What do I have to do to assemble a relationship with this property so that we’re in a position to nourish each other for the next quite a few a very long time?’”

Taylor and Graham began the search for a eternal farm website in a further cheap ZIP code better than a 12 months prior to now. On excessive of on no account realizing how prolonged their land tenure would ultimate in D.C., increasingly more, their crew was being priced out of residing shut by. Taylor heard about Mud Capital as a strategy to make the transition to land possession and was immediately struck by how fully completely different the dialog was with them compared with completely different funders.

For one issue, she talked about, the Mud Capital crew started by asking, “How rather a lot can you pay a month?” They then used that amount to design the financing throughout the land purchase. Taylor and Graham don’t technically private the land—however. The easiest way it actually works, Israelow explains, is that Mud Capital first seeks out what he calls “distinctive land stewards.”

“Loads of cases they’re at that influx stage of improvement the place they’ve that set of experience and their markets established and know what they’re doing, nevertheless they need that land security, need further land to develop, or need a home farm to basically protected a base,” he talked about.

Every mission could be assessed primarily based totally on its functionality to ship all through an have an effect on framework that options interconnected elements like racial equity, soil properly being, and native climate resilience. As a result of the chickens and cover crops convey the soil once more to life, for example, the land’s functionality to hold carbon and persistently produce nutritious meals as a result of the local weather modifications will improve.

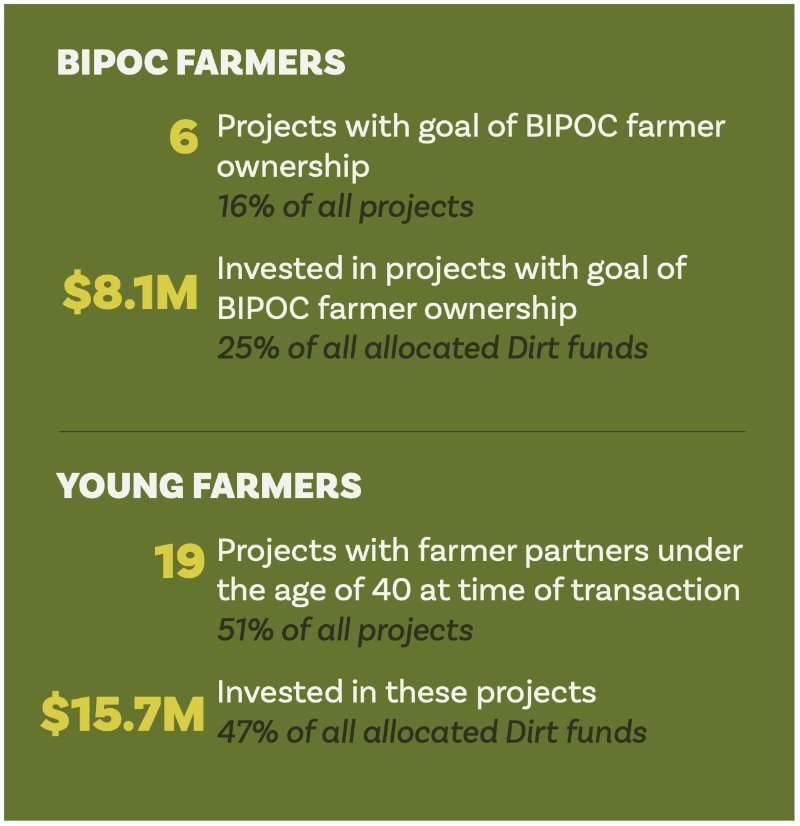

(Chart courtesy of Mud Capital’s 10-year have an effect on report)

Mud Capital buys the land after which leases it a month-to-month well worth the farmers know they may afford. The ten-year lease comes with two options to purchase, at 5 and 10 years. Most importantly, Mud Capital models the well worth the farmers pays at each of those elements in the end primarily based totally on their purchase value and a set, low appreciation value. So, whether or not or not they make lease funds for five or 10 years, if the market value of the land is rising (which it normally is), the farmers are setting up equity.

The funding partnership merely celebrated its 10-year anniversary, and by the tip of the 12 months expects to have achieved 44 initiatives. Of those, 9 farmers in the meanwhile are full householders of their land. These embrace pure, grass-fed dairy farmers who now private better than 300 acres in upstate New York and an immigrant family from Mexico who now owns their produce farm in New Jersey.

The remaining are completely on their method to possession. Whereas quite a few farmers Mud Capital labored with decided to carry up their hoes or their enterprise went bankrupt, they haven’t however had a case the place the farmers made it to the tip of the 10-year time interval and couldn’t transition to full possession.

All of it is funded by have an effect on merchants, a time interval for a lot of who’re ready to simply accept minimal returns so their money might make a distinction on the planet. They pay Mud Capital’s cost, Israelow outlined. His crew works to find completely different options which will enhance value for farmers, equal to conservation easements or community-scale picture voltaic.

“We’re investing in help of farmers, nevertheless we’re moreover taking money from them, correct? So, every buck we get from our farmers is a buck a lot much less of their checking account,” he talked about. Whereas most lenders would try to maximise the money flowing their means, Mud Capital objectives inside the completely different route. “Part of our goal is profitability and wealth-building for farmers.”